What is CIBIL SCORE?

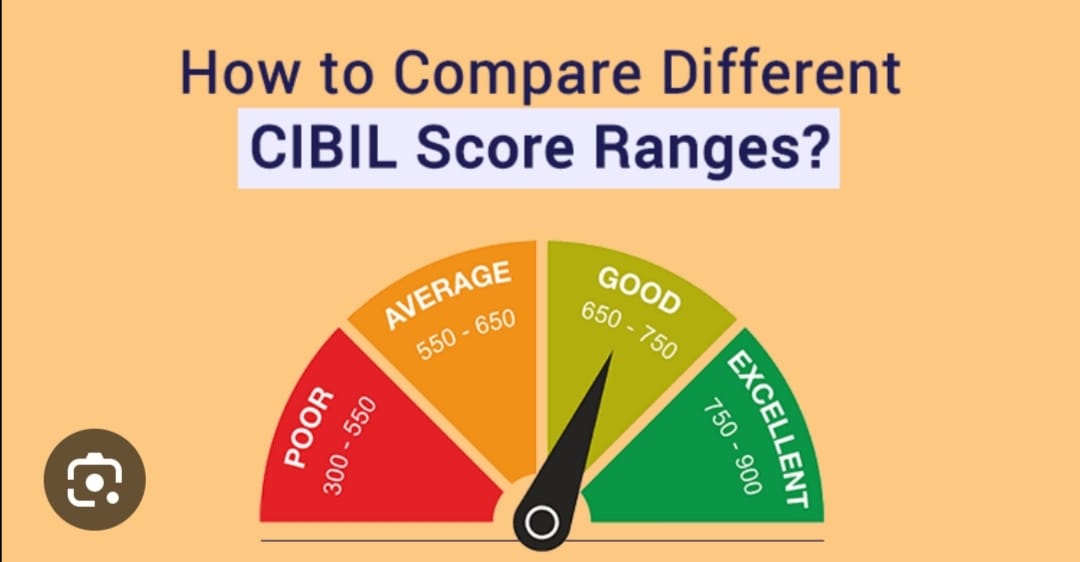

A CIBIL Score or Credit Score is issued by the Credit Information Bureau of India Limited to every borrower that denotes his or her creditworthiness which is determined by factors such as payment and credit history, types of credit and number of loan accounts, due loan amount, etc. It is a three-digit number that ranges between 300-900 which is calculated on the basis of the financial history of the applicant.

So, how much CIBIL Score is required for a personal loan? Well, if you have a CIBIL score of 750 or more, you are good to go.

How can you check Cibil score?

Credit score check is a simple process. You can do it yourself on the CIBIL website. Here are the steps to follow:

1. Visit the official website of CIBIL.

2. Once you are on the CIBIL website, click on the ‘Get Your CIBIL Score’ button.

3. After this, you will be presented with subscription options. Choose one option as per your choice.

4. Upon selecting the option, you will be taken to an online form. Provide the basic details here: your name, address, ID proof, birthdate, etc.

5. After filling up the form, you will be redirected to the payment page. Make the required payment through various modes like credit cards, net banking, etc.

6. Once the payment goes through, you will be taken to an authentication page. Here, you will be asked a few questions related to your credit history, which will help to authenticate your identity with CIBIL.

7. After your authentication process is complete, you will receive a detailed CIBIL report on your registered email address within the next 24 hours.

8. Congratulations, your credit score check is complete.

Why is credit score important?

Credit scores are indicators that allow a financial institution to assess your ability to repay the debt on time. The credit score is thus crucial in determining the risk of an individual or an asset.